- Our Services

-

-

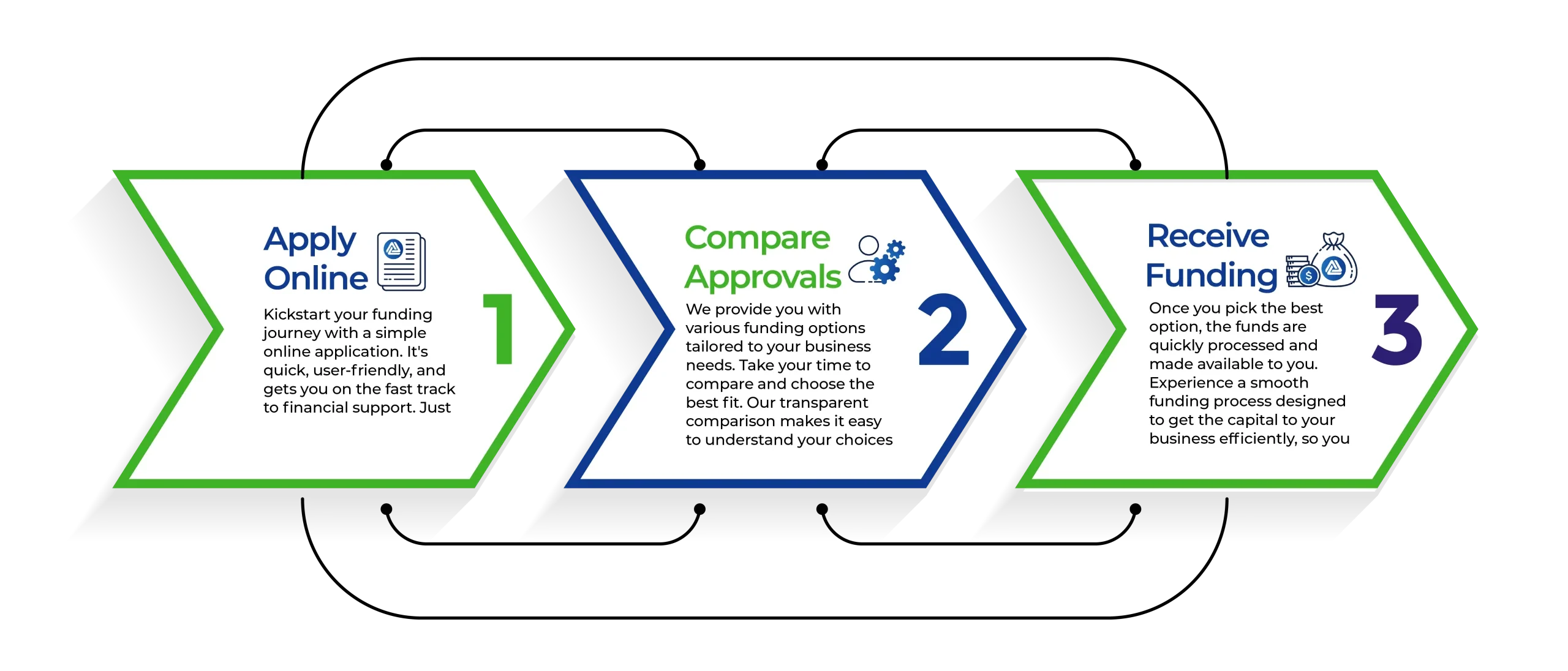

Let’s See

If We MatchApply now to see how much working capital your business may qualify for in just a few minutes.

All you need to qualify is:

☑1 year in business

☑$10k+ in monthly revenue

☑625 FICO Score

-

-

- Our Company

- Resource Hub

- Partners & Affiliates